Medicare, a cornerstone of the U.S. healthcare system, has evolved into a lifeline for millions of Americans. But how did it all begin? In this article, we delve into the origins and history of Medicare, explore the key milestones that shaped the program, and highlight how Medicare agents play a crucial role today.

The Beginning: Why Was Medicare Needed?

Before the 20th century, there were no national healthcare programs in the U.S., and most Americans paid out of pocket for medical care. As medical costs soared, especially for the elderly, many people found it impossible to afford necessary care. By the 1930s and 1940s, social safety nets such as Social Security began to emerge, but there was still no federal health insurance for seniors.

The First Steps Toward Medicare (1940s-1960s)

Healthcare reform gained momentum after World War II, but opposition from the private insurance industry and political parties slowed progress. Despite efforts by President Harry Truman to introduce a national health insurance program in 1945, his proposals faced heavy resistance.

It wasn’t until the 1960s that healthcare reform became a national priority. The aging population, rising medical costs, and limited access to private insurance for seniors finally pushed the federal government to act.

- 1961: President John F. Kennedy began advocating for a government-run health plan to cover older Americans.

- 1965: President Lyndon B. Johnson signed the Medicare and Medicaid Act into law, creating Medicare to provide hospital and medical insurance for seniors over 65.

What Exactly Is Medicare?

Medicare was initially designed to cover healthcare costs for people aged 65 and older. It provides two essential parts:

- Part A: Covers hospital stays, hospice care, and limited home healthcare.

- Part B: Provides outpatient services, preventive care, and doctor visits.

Since its inception, Medicare has expanded significantly. Today, it also offers:

- Part C: Medicare Advantage Plans, which allow beneficiaries to receive Parts A and B benefits through private insurers.

- Part D: Prescription drug coverage introduced in 2006.

Key Milestones in Medicare’s Evolution

- 1972: Medicare extended coverage to individuals under 65 with disabilities and those with end-stage renal disease.

- 1997: The Medicare Advantage program (previously Medicare+Choice) allowed private companies to offer healthcare plans to beneficiaries.

- 2003: The Medicare Modernization Act added Part D, helping beneficiaries afford prescription medications.

- 2010: The Affordable Care Act (ACA) brought new preventive care benefits to Medicare and closed the Part D “donut hole.”

- 2020: Telehealth services expanded under Medicare to provide virtual care, especially in response to the COVID-19 pandemic.

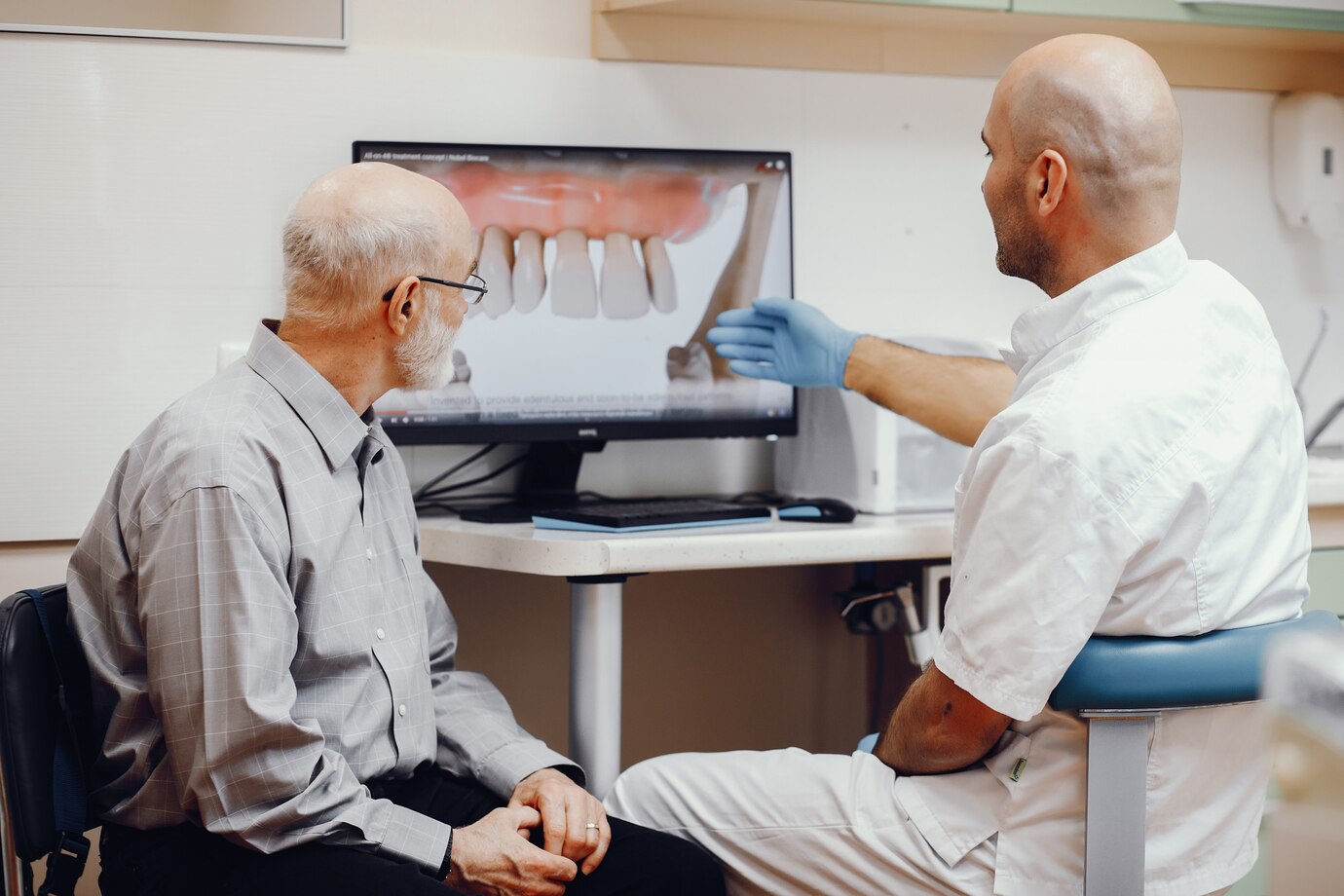

The Role of Private Insurance and Medicare Agents

Since the introduction of Medicare Advantage and Part D, the involvement of private insurance companies has grown significantly. Many beneficiaries rely on a Medicare agent to help them navigate the complex choices between Original Medicare, Medicare Advantage, and Part D prescription plans.

A Medicare agent provides essential guidance by:

- Explaining plan options and costs.

- Assisting beneficiaries in comparing coverage.

- Enrolling individuals in suitable plans tailored to their health needs.

With the continuous updates to Medicare plans and rules, the role of these agents has become more important than ever.

Medicare’s Impact on American Healthcare

Since its establishment, Medicare has transformed the way healthcare is delivered to seniors and disabled Americans. It has:

- Reduced the number of uninsured seniors.

- Provided affordable access to healthcare for millions.

- Improved the financial security of older adults.

- Created a platform for innovation, such as value-based care.

Beyond its direct impact on patients, Medicare has set standards for healthcare policies followed by private insurers, influencing the broader healthcare landscape.

Challenges Medicare Faces Today

Despite its success, Medicare also faces several challenges:

- Funding Shortfalls: With an aging population, the financial sustainability of Medicare is a growing concern.

- Rising Healthcare Costs: Prescription drug prices and advanced medical treatments are increasing costs.

- Fraud and Abuse: The size and complexity of the program make it vulnerable to fraudulent claims.

- Navigating Plan Options: With the growing number of Medicare Advantage and Part D plans, it can be difficult for beneficiaries to choose the right plan, making the role of a Medicare agent essential.

The Future of Medicare

As the U.S. population continues to age, Medicare will need to evolve to meet future demands. Policymakers are considering various reforms, including:

- Expanding eligibility to people younger than 65.

- Negotiating drug prices to reduce prescription costs.

- Introducing new payment models to ensure value-based care.

Technology will also play a significant role, with telemedicine and digital health solutions becoming permanent features of the Medicare system.

Conclusion

Medicare has come a long way since its origins in the 1960s. What began as a modest program to help older Americans access healthcare has grown into a crucial safety net for millions. From its historical beginnings to its modern-day expansions, the program continues to evolve to meet the changing needs of society.

If you’re exploring your Medicare options today, working with a trusted Local Medicare agent can simplify the process. Their expertise can ensure you choose the best plan that fits your healthcare and financial needs.