Securing a construction loan is a crucial step for anyone looking to finance the building of a commercial property. Whether you’re building a new business facility, expanding your real estate portfolio, or starting from the ground up with a new construction project, the financing process is integral to success. One of the key elements lenders assess when considering your construction loan application is your FICO score. In this blog, we’ll explore the minimum FICO score requirements for construction loans and provide practical tips to help you improve your chances of approval.

Understanding FICO Scores and Their Importance in Construction Loans

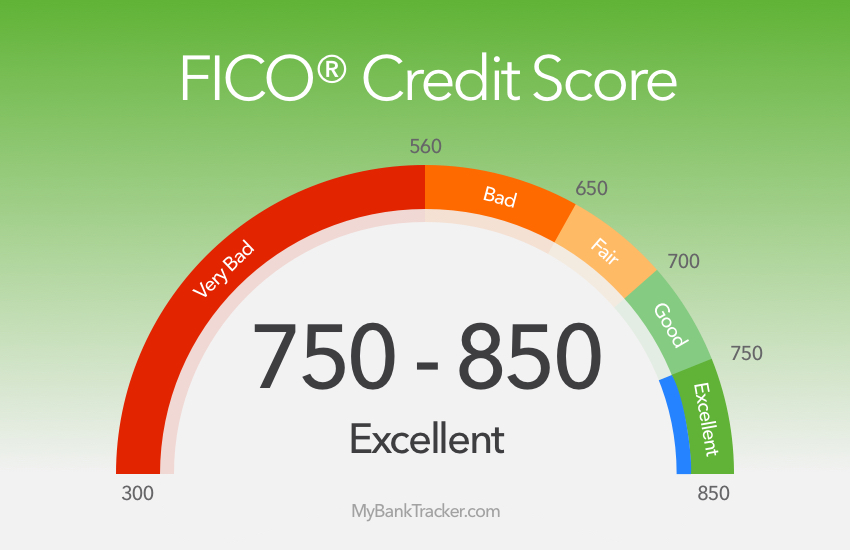

When applying for a construction loan, lenders scrutinize your credit score, also known as your FICO score, to evaluate your creditworthiness. The FICO score is a three-digit number that ranges from 300 to 850 and reflects your credit history, debt levels, payment history, and other financial behaviors.

Why Does FICO Score Matter?

For lenders, your FICO score is an essential risk assessment tool. It indicates your reliability in repaying debts and helps them predict the likelihood of default. Construction loans, especially for large projects, are inherently risky. Lenders often require higher FICO scores for these loans because of the longer loan term, the uncertainty of project completion, and the various risks involved in construction.

The higher your FICO score, the better your chances of securing a construction loan with favorable terms, including lower interest rates and down payment requirements. On the other hand, a lower FICO score may result in stricter terms or even loan denial.

What is the Minimum FICO Score for a Construction Loan?

Typical Minimum FICO Score Requirements

The minimum FICO score requirement for a construction loan can vary depending on the lender, type of loan, and the specifics of your project. However, here are some general benchmarks:

For conventional construction loans: Most lenders prefer a minimum FICO score of 680 to 720. Borrowers with scores in this range may qualify for competitive rates and terms.

For FHA construction loans: These loans are more lenient, with minimum FICO score requirements starting at 580. However, higher scores will give borrowers better terms.

For VA construction loans: The Department of Veterans Affairs does not set a strict minimum FICO score for VA construction loans, but most lenders prefer a score of 620 or higher.

For private construction loans: Private or hard money lenders may approve construction loans for borrowers with lower credit scores, sometimes as low as 500, but these loans come with higher interest rates and larger down payment requirements.

Why Do Minimum Score Requirements Vary?

Different lenders have varying risk tolerances, and your loan terms will depend on a variety of factors, including:

The size of the loan: Larger loans pose a greater risk, which often results in higher FICO score requirements.

The nature of the project: Riskier or more complex projects (e.g., multi-unit developments) may require higher credit scores.

Your financial history: A strong history of on-time payments and low debt can offset a lower FICO score in some cases.

Factors That Influence FICO Score Requirements

Several factors can influence the minimum FICO score required for a construction loan, making it crucial to understand what lenders consider when evaluating your application.

1. Type of Construction Loan

The type of loan you apply for will affect the FICO score requirement. For instance, FHA and VA loans tend to have more lenient credit score requirements than conventional or private loans. This is because government-backed loans come with additional protections for lenders, allowing them to take on more credit risk.

2. Loan Amount and Project Scope

The size of your construction loan can influence the minimum FICO score. Larger loans often come with stricter requirements, as they represent a greater financial risk to the lender. Similarly, more complex projects, such as multi-unit developments or mixed-use properties, may require higher credit scores because they carry greater risks during construction.

3. Lender Guidelines

Different lenders have their own underwriting guidelines. Some may prioritize FICO scores heavily, while others may focus more on your project plan, financial health, or down payment. It’s essential to shop around and talk to multiple lenders to find one that suits your financial profile and project needs.

4. Down Payment and Collateral

Lenders are more likely to overlook a lower FICO score if you can offer a larger down payment or substantial collateral. Having significant equity in your project reduces the lender’s risk and improves your chances of approval, even if your credit score is less than perfect.

Improving Your FICO Score for a Construction Loan

If your FICO score is lower than the minimum requirement for a construction loan, there are several strategies you can use to improve it before applying.

1. Pay Down Existing Debt

One of the quickest ways to boost your FICO score is by reducing your debt-to-income (DTI) ratio. Paying down existing credit card balances or loans can significantly improve your credit utilization, which accounts for about 30% of your credit score.

2. Ensure Timely Payments

Your payment history is the most significant factor in your FICO score, making up 35% of the total. Ensure that you consistently make on-time payments for all existing debts. Setting up automatic payments or reminders can help you avoid missed payments.

3. Correct Credit Report Errors

Errors on your credit report can negatively affect your FICO score. It’s essential to regularly review your credit reports for any mistakes or inaccuracies. If any are discovered, dispute them with the credit agency so that they can be fixed.

4. Avoid Opening New Credit Accounts

While it may be tempting to open new lines of credit, doing so can temporarily lower your FICO score. Avoid opening any new accounts in the months leading up to your construction loan application to maintain your credit score.

Case Studies: Real-Life Examples of FICO Score Impacts

Case Study 1: Commercial Real Estate Developer with a 750 FICO Score

A real estate developer with a FICO score of 750 applied for a construction loan to build a shopping complex. Due to the developer’s strong credit score and significant experience in real estate, the lender offered competitive terms, including a low 10% down payment and an attractive interest rate. The developer was able to secure the loan and complete the project on time, with minimal financial strain.

Case Study 2: First-Time Business Owner with a 620 FICO Score

A first-time business owner with a FICO score of 620 sought financing to build a small office building. Despite the lower credit score, the borrower had a detailed business plan and significant collateral in the form of personal real estate. The lender approved the construction loan but required a higher down payment of 25% to offset the risk posed by the lower FICO score.

FAQs

Q: What is the minimum FICO score for a construction loan?

A: The minimum FICO score for a construction loan varies by lender and loan type, but typically ranges from 580 to 720, depending on the specific loan program and borrower’s financial profile.

Q: Can I get a construction loan with a low FICO score?

A: Yes, it’s possible to get a construction loan with a low FICO score, but you may face higher interest rates, larger down payment requirements, or additional collateral to secure the loan.

Q: How can I improve my FICO score before applying for a construction loan?

A: You can improve your FICO score by paying down existing debts, making timely payments, reviewing your credit report for errors, and avoiding new credit inquiries.

Contact Us for Expert Construction Loan Guidance

At Commercial Construction Loans, we specialize in helping business owners and developers secure the financing they need to bring their projects to life. Whether you’re just starting or expanding your operations, our team of experts is here to guide you through the process, including helping you navigate the FICO score requirements for construction loans. Contact us today to learn how we can assist you in securing the right loan for your project.